Interview • Challenges & disruptions

The €32 billion diagnostic imaging market at a crossroads

The annual congress of the ESR is a great showcase for the latest advances in the imaging sciences and an important platform to see where the industry is heading.

In an interview with European Hospital, Professor Hans Maier, former President of Bayer Diagnostic Imaging and now Co-Founder and Managing Partner of the healthcare advisory firm BGM Associates, summarises the current industrial and competitive dynamics in imaging and shares his thoughts on how increasing competition, novel technologies and a changing radiology service provider landscape set the industry in motion.

We are witnessing a wave of consolidation and new partnerships in the imaging industry: Guerbet acquired Mallinckrodt’s contrast business, Toshiba seeks a partner for its Medical Devices division and IBM has acquired Merge Healthcare. What drives such developments?

‘To a great extent, our industry has been an oligopolistic market, particularly in devices, contrast media and injection systems. A handful of companies make up the vast majority of the €32 billion diagnostic imaging industry. We currently see a quite unique combination of factors that is likely to change the industry landscape significantly.

‘The market for diagnostic imaging equipment is becoming more competitive with a number of new entrants from emerging markets, such as the South Korean electronics giant Samsung, which has recently presented a 128-slice high-end CT machine with a speed of 0.25 s. per rotation, or China’s Neusoft Medical, which has recently received CE-clearance for its 128-slice CT machine in Europe.

‘While innovation still happens, imaging hardware for most indications is fairly mature, therefore it will be ever more difficult for the large engineering companies to differentiate in competition with incremental improvements of hardware specifications only.

‘The leading contrast media companies will see increasing generic competition as the remaining contrast agent patents expire within the next years. The current debate on gadolinium-retention is a critical issue requiring further investigation. I expect this to accelerate the shift towards macro-cyclic MRI contrast agents. The fact that most major players exited molecular imaging shows how difficult it is to develop new promising products and build new areas of growth.

‘At the same time, we see a new group of companies entering the field from the information technology world and IBM’s acquisition of Merge has brought more attention and dynamics to this process. These industry trends spur a wave of consolidation in search of scale and access to complementary technologies and end customers.’

In the future, what major innovation drivers could allow companies to gain competitive advantages?

‘The current iodine-based low osmolar X-ray contrast media and Gadolinium-based macro-cyclic MRI agents are regarded as very safe and gold standards in their respective modalities

Hans Maier

‘While the CT technology is very mature, we may see more distinct devices, for instance in intraoperative and interventional applications and specific indications, such as breast imaging. Overall, we see more potential for significant improvement in MRI, with faster devices expanding the range of indications, improving patient comfort and affordability; also, in ultrasound, novel systems may reduce operator dependence and facilitate contrast-enhanced applications.

‘The current iodine-based low osmolar X-ray contrast media and Gadolinium-based macro-cyclic MRI agents are regarded as very safe and gold standards in their respective modalities. Therefore, the development of novel agents faces very high benchmarks and significant investment, while the economic viability remains uncertain in a restrictive reimbursement environment.

‘The fate of Amyloid-imaging greatly depends on the availability of novel Alzheimer’s therapies, so we will continue to see novel targeted molecular imaging agents, some of which bear the potential of providing innovation in specific applications, primarily in oncology.

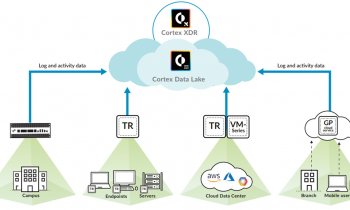

‘However, the major innovation driver will be novel software applications. Large IT companies, such as IBM and SAP, but also start-ups such as Enlitic, Arterys or Zebra Medical, have made great progress in developing cloud-based platforms and learning algorithms to structure medical information and apply abundant computing power to recognise pattern within and across diagnostic data sets. These tools are already selectively available today to support the diagnostic workup and decision-making and we expect them to gain adoption steadily.’

How will those innovations influence radiology service providers?

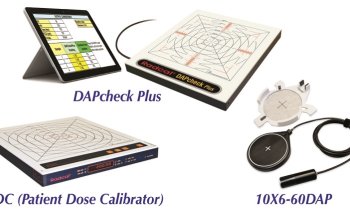

‘The radiological discipline faces a number of critical challenges, such as the variance in quality and a lack of standardisation, vast differences in radiation and contrast dose exposition across hospitals and countries, the high workload of radiologists and a lack of qualified personnel in some parts of the world, as well as the still very fragmented radiology ecosystem.

‘In parallel, we witness a time of cost containment that encourages an ‘industrialisation’ of radiology workflows and favours the emergence of consolidated and professionalised imaging centres and imaging networks.

‘Some of these problems will certainly benefit from novel software solutions to standardise processes and support image interpretation. Moreover, software will be the basis for radiology to connect with other diagnostic services such as in-vitro diagnostics and pathology, and can help foster the role of the radiologist in a world where ever more medical disciplines make use of imaging technology to prepare and guide diagnostic and therapeutic interventions independent of the radiology practice.’

The time is right to integrate the components of the radiology ecosystem

Hans Maier

‘I believe It’s important for incumbents to think beyond the current company boundaries and to engage in new, maybe unconventional, partnerships. The time is right to integrate the components of the radiology ecosystem, for instance, to expedite a much closer integration of image acquisition and contrast injection protocols, but also beyond radiology with other diagnostic and therapeutic disciplines.'

‘Organisational research tells us that it’s challenging to overcome the legacy of a company and to implement such significant change. However, I would advise companies to create a philosophy of open innovation that promotes partnering with other companies and a closer collaboration with academia, radiology and diagnostic service providers and payers.'

'Many companies have pursued the vision of integrated diagnostics – to date with only modest success. Now that this vision becomes a reality, it remains to be seen whether the diagnostics companies can benefit from this opportunity, or whether outside IT companies, such as Google and the like, will conquer this new domain.’

For a comprehensive report please see www.bgmassociates.com

Profile:

Professor Hans Maier led the Global Diagnostic Imaging Business at both Schering AG and Bayer AG. He serves on the Board of Medical Institutions, such as the German Heart Institute, Berlin, and the Fraunhofer MEVIS Institute for Medical Image Computing. He is also an adviser to pharmaceutical and medical technology companies worldwide through his consulting firm BGM Associates.

01.03.2016